Trends

Buy now, pay later could help airline recovery

Buy now, pay later solutions may change the mindsets of many young travelers that deemed international trips to be too expensive. according to GlobalData.

An increasing number of airlines are partnering with fintech companies offering buy now, play later solutions. This new payment method could work wonders with Millennial and Gen Z consumers.

Millennials and Gen Z will be the two cohorts driving demand for low-cost travel options in the short-to-medium term, as they were hit particularly hard by the pandemic.

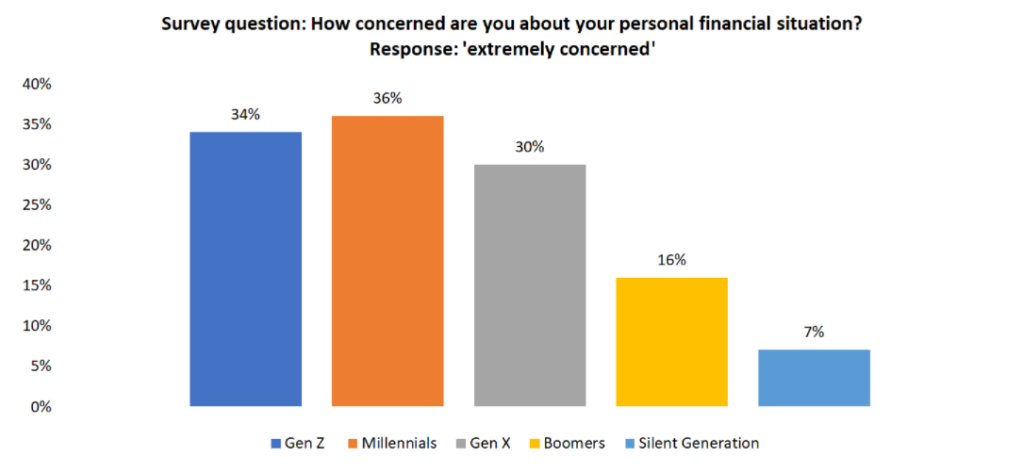

When looking at the response of specific age cohorts when asked how concerned they were about their personal financial situation in a GlobalData survey, 34% of Gen Z and 36% of Millennials stated that they were ‘extremely concerned’, which were the two highest percentages out of all the age cohorts that responded to this question.

Buy now, pay later solutions may change the mindsets of many young travellers that deemed international trips to be too expensive in relation to their levels of disposable income and savings.

This method of payment is also technologically advanced, which Gen Z is receptive to. 43% of this cohort stated that they were either ‘often’ or ‘always’ influenced by how digitally advanced a product or service was, according to a GlobalData survey.

Forging strong partnerships

Uplift, a buy now, pay later solution serving travel brands, deepened its partnership with Southwest Airlines in January 2022. Customers can book their Southwest flights to the Hawaiian Islands with interest-free payment options through the partnership.

Southwest’s interest-free promotion is available for purchases as low as $49 one-way and for three or six-month terms, with no late fees or prepayment penalties. Additionally, customers can book and fly even before they are finished making their payments.

The terms ‘interest-free’ and ‘no late fees’ will no doubt attract price-sensitive Millennial and Gen Z travellers that are looking flexible, low-cost payment methods.

Most importantly for airlines and their recovery timelines, buy now, pay later enhances accessibility as smaller payments can be made over a number of months, which translates to higher load factors. The accessibility that this payment solution can offer means it is not only low cost carriers taking advantage of buy now, pay later.

Delta and American Express announced their joint venture last month. Delta’s flexible payment option allows for Amex customers to break up their Delta purchases into monthly payments for an additional fee when the customer reaches the checkout page when booking online.

Airlines such as Delta can’t afford to only be seen as a premium service, as it will struggle to attract Gen Z and Millennial passengers. Through this payment option, Delta can get its foot in the door with these younger cohorts, then try to create repeat custom through its loyalty program rewards.

Buy now pay later could play a key part in the recovery of airlines that have adopted this payment method. Flexibility and affordability are key influencing factors for younger travelers, and this offering could even inspire a lifetime of loyalty.

Main image: