UKRAINE CRISIS BRIEFING

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 8 June

Since Russia launched a full-scale military invasion of Ukraine on 24 February, data from the United Nations Refugee Agency indicates that around seven million people have crossed the Ukrainian border as of 1 June.

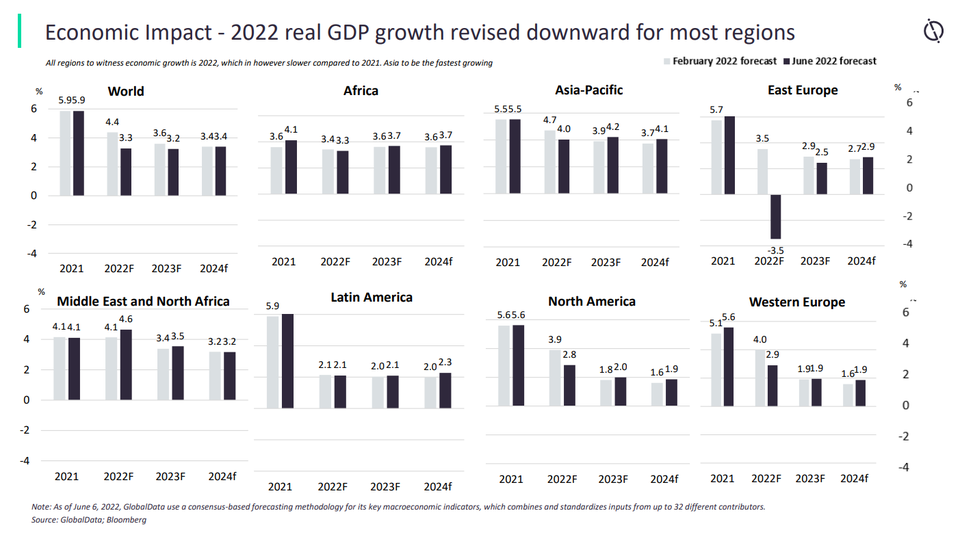

GlobalData forecasts that the world economy will grow at a slower pace of 3.3% in 2022, following a 5.9% growth in 2021. The global inflation rate is projected to rise to 7% in 2022 from 3.5% in the previous year due to supply chain disruption.

- SECTOR IMPACT: TRAVEL AND TOURISM -

Latest update: 8 June

Revenue impact

In late April, Eurocontrol, the European organisation for the safety of air navigation, noted that oil had spiked to $152 a barrel due to Russia’s invasion of Ukraine. The organization stated that many airlines were not viable with oil at $100 a barrel.

Airlines that have not hedged their fuel needs could end up in a precarious situation. Increased fuel costs mean higher ticket prices for travellers, which could deter many price-sensitive consumers from flying.

Sector analysis from UK-based hotel booking platform hoo states that the Ukraine crisis could cost $10.6bn in lost tourism revenue across Ukraine, Russia, Belarus, and Moldova, with further impacts likely to be felt across neighbouring countries. The loss of Russian tourists will prolong the Covid-19 recovery timelines of specific destinations.

According to GlobalData, Russia was the fifth-largest country globally in terms of international departures in 2021, at 13.7 million. Additionally, travellers from this nation spent a total of $22.5bn in 2021, which put Russia in the top 10 for total outbound tourist expenditure.

These figures show the importance of Russia as an international source market for tourism, and one that will be sorely missed by many destinations that are now not accessible to Russians.

Travel enters a new era

Low tourist demand means many cars rental companies have been forced to sell their fleets in order to stay afloat during the Covid-19 pandemic.

Markets in which airport pickup is the largest channel, such as the US, have particularly suffered, but the effect has been felt all over the world.

But as demand picks up, with more people traveling and supply still down, major price hikes are likely to be in store for anyone who wants to rent a car.

Key Travel And Tourism developments

SANCTIONS

Many non-Russian airlines are having to take diversions to avoid flying through Russian airspace. Closed airspace translates to longer flight times, increased fuel usage, more pilot hours, higher costs, and consequently higher fares. Higher fares could further impact the recovery of many airlines with global operations.

In May 2022, Thailand’s Minister of Commerce stated that Thai banks had displayed interest in Russia’s proposal to introduce the Mir payment system for Russian travellers in Thailand and pledged to coordinate with the appropriate Tourism and Transport ministries to facilitate direct flights from Russia. This comment demonstrates that Thailand has acknowledged it now has a key opportunity to become a major destination for Russian travellers in the coming years, as EU sanctions change preferred destinations for Russians.

DEMAND DISRUPTION

Travel enters a new era

Low tourist demand means many cars rental companies have been forced to sell their fleets in order to stay afloat during the Covid-19 pandemic.

Markets in which airport pickup is the largest channel, such as the US, have particularly suffered, but the effect has been felt all over the world.

But as demand picks up, with more people traveling and supply still down, major price hikes are likely to be in store for anyone who wants to rent a car.

Demand disruption caused by the crisis is heavily impacting Russia’s airline and airport sectors. A lack of domestic and international travel has heavily impacted Aeroflot. As a result, the Kremlin was weighing up in April whether to use around RUB107bn ($1.84bn) from its sovereign wealth fund to recapitalise the airline.

Russia’s isolation is now raising concerns regarding how its carriers will gain access to spare parts and maintenance that were previously provided by the West. This could create significant safety issues, as maintenance attempts may not meet international standards.